Warren Buffett's $6.2 Billion Bank of America Stock Sell-Off Explained

Written on

Chapter 1: Buffett's Early Beginnings and Current Wealth

Warren Buffett, known for his wit, once quipped that he would leap from Omaha's tallest building if he hadn’t become a millionaire by age 30. Remarkably, by the age of 14, he had already adopted the well-known strategy of compounding. He placed pinball machines in barbershops, sharing the profits with the barbers and reinvesting his earnings to expand his collection.

By the time he turned 21, Buffett had saved up $20,000 (equivalent to approximately $220,000 today) through newspaper deliveries, selling golf balls, and operating his pinball business. Now at 93, his net worth stands at a staggering $149 billion, and he has committed to donating it all to five charities after his passing.

One of the admirable traits of Buffett, beyond his philanthropic efforts, is how he uses humor to counter critics who claim he is hoarding excessive wealth. He often puts them in their place with a clever remark. For instance, he joked about continuing to run Berkshire Hathaway even after his death, although his successor, Greg Abel, will be responsible for stock decisions and asset management going forward.

Warren Buffett:

> “That decision actually will be made when I’m not around, and I may try and come back and haunt them if they do it differently. But I’m not sure the Ouija board will get that job done.”

Section 1.1: Current Market Strategies and Signals

Interestingly, both Buffett and Abel seem to be cautious about U.S. stocks at the moment. Between early 2022 and mid-2024, they divested billions from Berkshire's main assets, leading to a 161% increase in their cash reserves, which now total an impressive $276.9 billion.

(Note: Buffett's cash reserves now make up 27% of assets, significantly higher than the 13% average since 1996, yet still below the 40% peak reached in 2004.)

In a recent SEC filing, it was revealed that they sold 150 million shares of Bank of America for $6.2 billion, reducing their stake by 14.5%. Nevertheless, they still hold an 11.4% interest valued at approximately $36 billion. With $90 billion worth of stock sales in the first half of 2024 and more divestitures anticipated, investors are understandably anxious.

The cash accumulation by Buffett and Abel may suggest an impending market downturn. During Berkshire Hathaway's annual gathering, Buffett remarked, "The incredible period of growth for the U.S. economy is ending." His long-time partner, Charlie Munger, even warned, "We should get used to making less."

In a similar vein, JP Morgan's Jamie Dimon described the current climate as "the most dangerous time the world has seen in decades." With all the fiscal and monetary stimulus, he expressed concerns about what 2025 may have in store.

British investor Jeremy Grantham, renowned for identifying market bubbles, has placed the likelihood of a recession at 70%, predicting a potential 50% drop in the S&P 500. He stated:

> “I think of myself as a realist trying to see the world as it is, not how I’d like it to be. Sometimes I get it right, sometimes I don’t.”

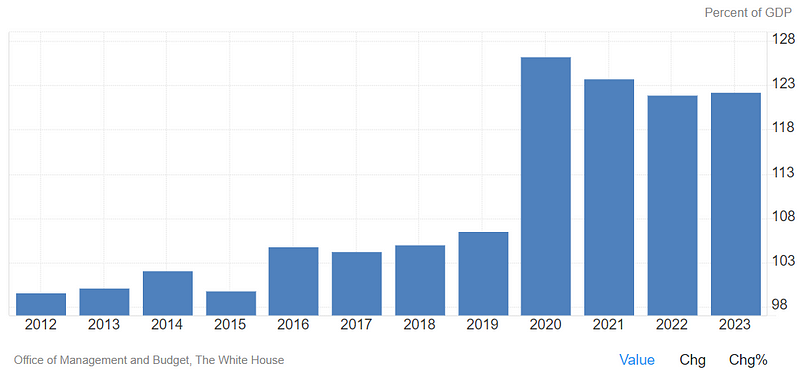

The U.S. GDP reached $26.97 trillion in 2023, falling short of the $33.17 trillion debt, resulting in a debt-to-GDP ratio of 123%. This figure is projected to rise to 124.30% by 2025:

Section 1.2: Understanding Economic Indicators

Prominent hedge fund manager Bill Ackman highlights the U.S.'s intrinsic value, emphasizing the potential to adjust tax policies to manage a 35% stake in national income. Despite having vast assets, including real estate and infrastructure, rising liabilities like debt, Social Security, and healthcare costs are alarming.

To gain insights into future productivity and corporate profits, many top investors monitor the ISM (Manufacturing Index). Buffett has already recognized the challenging landscape for businesses, supported by data indicating a 22% decline in retail sales.

Warren Buffett:

> “I get reports on what businesses are doing, and in retail, they’re down 22% in sales. Some are just living off orders from months ago.”

As Berkshire Hathaway's market capitalization hovers around $998 billion and cash reserves grow at 7% per year, Buffett is evidently biding his time for the opportune moment to invest. His cash reserves could easily purchase major companies like Samsung, Coca-Cola, or even Bank of America, leaving him with surplus funds.

He is vigilant, stating:

> “Supply lines were hit hard (during lockdowns), so no economic figures are pure, but I’m telling you, I look at sales daily, and they’re down.”

The ISM index serves as a reliable gauge, having accurately predicted every U.S. recession for the past 70 years. A score below 50 indicates contraction and a potential recession, while a score above 50 suggests growth, with anything over 60 indicating a booming economy. Currently, the index stands at 47.2; however, investing expert Raoul Pal believes signs of recovery may be emerging.

Subsection 1.2.1: The Importance of Patience in Investing

Buffett emphasizes the necessity of being the last one standing when the music stops:

> “Your investment thesis will be right because your data and reasoning are right.”

He’s not preoccupied with market predictions; instead, he concentrates on investing wisely in the most secure, risk-adjusted opportunities. His philosophy is:

> “We just want to be the last man standing, and if that means missing out on price appreciation by avoiding leverage, so be it.”

The Oracle of Omaha has successfully navigated six U.S. recessions and numerous market corrections. He asserts:

> “Nobody else can make a deal like we can when the time is right.”

His advantage lies in his patience, akin to a sniper awaiting the ideal moment for a shot. Buffett believes that a skilled CEO won’t hesitate during turbulent times—they’ll seize opportunities that others overlook. As his cash reserves expand, he hints that Greg will have even more exciting prospects to manage.

Warren Buffett:

> “Good companies might not want to sell, but they may need $20 billion. Several decent companies could find themselves in a tight spot with their borrowing structure, and when that money comes due at the wrong time, that’s when the phone calls start. And those calls are limited.”

Final Thoughts on Market Conditions

Many are interpreting Buffett's recent stock sales as an indication that the market is poised for a downturn. However, Buffett is not acting as a fortune teller—he's simply sitting on a substantial cash reserve, waiting for the right opportunity. The truth is, the future remains uncertain.

As the world's fifth richest individual, Buffett is adopting a cautious stance amidst a challenging debt cycle, potential global conflicts, and an unpredictable electoral landscape. The reality is that even as financial conditions deteriorate, asset prices may continue to rise, largely due to the ongoing need for monetary expansion.

According to global liquidity expert Mike Howell, stock prices merely reflect central bank balance sheets; as those increase, so do asset prices. He notes:

> “If you have an expanding Fed balance sheet and an expanding injection of capital, that’s a recipe for very strong global liquidity. The best time for asset prices is when economies are slow and sluggish, but policymakers are trying to stimulate them, and that’s what we’ve got.”

Buffett's decision to sell stock might be a signal worth overlooking.