Exploring Stock Price Predictions with Quantum Machine Learning

Written on

Chapter 1: Introduction to Quantum Machine Learning

In this article, we will explore the fascinating intersection of quantum computing and machine learning, particularly focusing on how quantum machine learning (QML) can be applied to stock price forecasting. Our primary aim is to evaluate the efficacy of a quantum neural network (QNN) against a traditional single-layer multilayer perceptron (MLP).

We will leverage the Historical API endpoint provided by Financial Modeling Prep (FMP) to gather trustworthy and precise data, which is crucial for our analysis. Let’s get started!

Section 1.1: Data Importation

To kick things off, we’ll import the essential libraries needed for our analysis. These libraries will equip us with the foundational tools to explore and implement our project.

import numpy as np

import pandas as pd

import requests

import json

import tensorflow as tf

from sklearn.model_selection import train_test_split

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense

from sklearn.metrics import mean_squared_error

from qiskit import QuantumCircuit

from qiskit.circuit.library import PauliFeatureMap

from qiskit.algorithms.optimizers import ADAM

from qiskit.circuit import Parameter

from qiskit.primitives import Sampler

We have established our environment by installing the Qiskit library, which is essential for working with quantum networks, along with other necessary libraries. To obtain the data, we will utilize the historical data API endpoint provided by FMP.

The FMP historical data API offers a user-friendly endpoint that grants access to a rich collection of historical stock data, invaluable for every phase of our analysis. This resource enhances the depth and accuracy of our project, contributing significantly to its success.

Now, we will extract historical data as follows:

# Make a GET request to the API

response = requests.get(api_url)

# Check if the request was successful (status code 200)

if response.status_code == 200:

# Parse the response JSON

data = response.json()

else:

print(f"Error: Unable to fetch data. Status code: {response.status_code}")

data

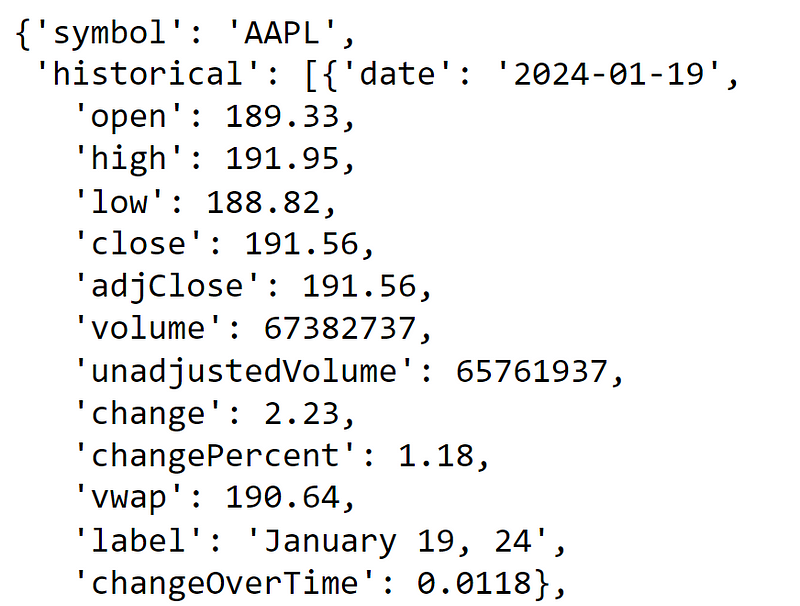

Make sure to replace YOUR API KEY with the secret API key you can acquire by signing up for an FMP account. The output will be a JSON response structured as follows:

Section 1.2: Understanding Quantum Computing

In classical computing, we utilize tiny switches known as “digital gates” to manage data flow, operating on bits that can be either 0 or 1. In contrast, quantum computers employ qubits, which can exist in multiple states simultaneously, allowing for more complex calculations.

When we refer to the “collapse of the wave function,” we mean that a qubit decides to represent either 0 or 1 upon observation. Qubits can be created using photons, atoms, or small electrical circuits, serving as the foundation for quantum computing.

These quantum systems exhibit intriguing properties such as superposition, entanglement, and tunneling, enabling quantum computers to potentially solve problems more efficiently than classical computers.

In our project, we will concentrate on parameterized gates, which exhibit behavior based on specific input parameters, denoted by the symbol θ. Notably, we focus on rotation gates that allow us to manipulate the state of qubits effectively.

The first video titled "Predict The Stock Market With Machine Learning And Python" provides insights into how machine learning can be applied in stock market prediction, illustrating its principles and techniques.

Subsection 1.2.1: Operators in Quantum Computing

Traditional computing operations use logic gates to process binary data. Quantum gates, however, manipulate qubits and rely on complex number mathematics.

For example, the quantum NOT gate flips the state of a qubit, and the Hadamard gate creates superpositions, allowing qubits to represent both states simultaneously.

The second video, "Coding Stock Prediction Using Machine Learning and Technical Analysis (MLSTM Neural Network Python)," demonstrates coding techniques for stock prediction using machine learning, showcasing practical applications of these algorithms.

Chapter 2: Quantum Neural Networks

In our study, we place significant emphasis on Quantum Neural Networks (QNNs) that leverage the unique features of quantum computing to perform tasks typically addressed by classical machine learning.

QNNs consist of multiple layers, each serving a distinct function, including input transformation, quantum state manipulation, and final measurement outputs. We will explore how to effectively implement these networks for time series forecasting in stock price predictions.

Section 2.1: Creating Quantum Embeddings

In QNNs, the input layer encodes classical data into quantum states through various encoding techniques, such as basis encoding or amplitude encoding. We will utilize a tensor product encoding method for our input layer.

The ansatz layer, which forms the core of the QNN, will be structured with parameterized gates that simulate multiple network layers. The output layer will perform measurements on the qubits to derive final predictions.

By using Qiskit, we can streamline the process of building our QNN, making the complex calculations more manageable.

Conclusion

In conclusion, this project has delved into the innovative applications of quantum computing and neural networks, emphasizing their potential for future advancements. As technology progresses, the development of more sophisticated quantum machine learning algorithms is on the horizon.

With ongoing improvements in quantum computing, we can expect enhanced computational capabilities, opening new avenues for problem-solving in machine learning applications.

Thank you for reading! Feel free to share your thoughts on Quantum Machine Learning and its implications in the stock market in the comments below.