Setting Achievable Investment Objectives in Cryptocurrency

Written on

Chapter 1: The Importance of Defining Investment Goals

Establishing clear objectives is crucial in any investment journey, especially in the volatile realm of cryptocurrency. Without a defined endpoint, it becomes challenging to navigate the complexities of the market. In this discussion, we will explore effective strategies for setting and achieving these goals.

Disclaimer: The content provided here is for educational purposes only and does not constitute financial advice. I am not affiliated with any mentioned projects or companies. Always invest responsibly and only use funds you can afford to lose.

Chapter 1.1: Understanding the Need for Investing

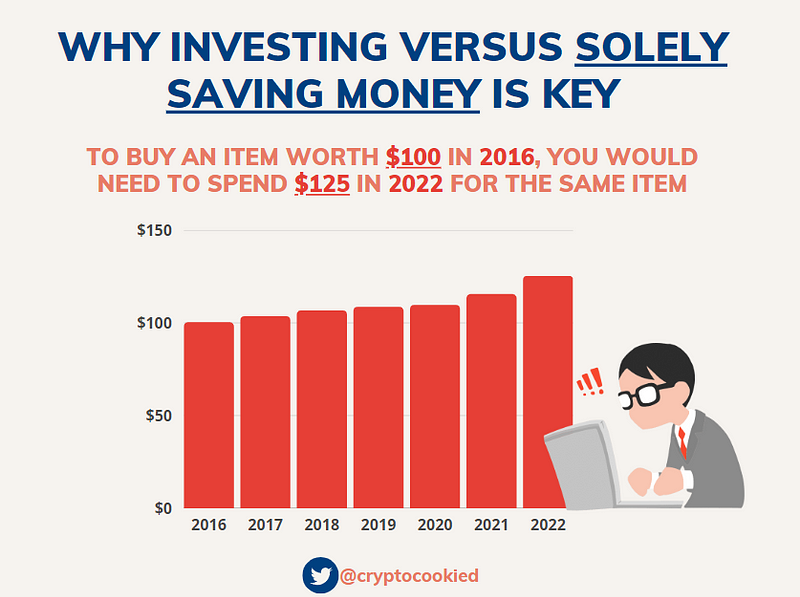

Investing is vital because traditional currencies, often backed by debt, tend to lose value over time. This depreciation occurs globally, making it essential to seek better returns through investments that can counter inflation.

For instance, if you deposited $100 in savings in 2016, you would need $125 by 2022 just to maintain the same purchasing power. The interest from savings accounts typically falls short of offsetting this loss. Thus, investing becomes a necessary strategy to safeguard against inflationary pressures.

Chapter 1.2: Budgeting Before Investing

Creating a budget is straightforward yet essential for financial health:

- Identify your monthly income.

- List all your expenses.

- Subtract your expenses from your income.

The leftover amount is where your investment budget can emerge. It's vital to reserve necessary funds for key expenditures, such as purchasing a home. Personally, I prefer to invest using supplementary income, while my primary earnings cover daily expenses. For more insights, check out my article, “Are You Investing in Crypto Wrong?”

Chapter 2: Setting Realistic Expectations

The adage “it takes money to make money” rings true. I began my investment journey with a modest sum of around $1200-$1400. My initial goal was to increase that to $10,000, followed by another target of $10,000. This incremental approach allowed me to adjust my budget and risk management as I progressed.

Chapter 2.1: The Value of Research and Tools

During a bull market, it might seem easy to profit from crypto and stocks. However, the absence of proper research and tools can lead to significant losses. Diligent research is the most challenging aspect of investing, requiring extensive time and effort. While influencers can motivate you, they cannot guarantee your financial success.

Here are seven essential tools I utilize regularly:

- TradingView: A platform for tracking market movements, offering basic functionality for beginners.

- DexScreener: Perfect for monitoring token pairings in decentralized finance (DeFi).

- Dune Analytics: A resource for blockchain research, albeit more complex.

- Notion: Useful for organizing thoughts, ideas, and research.

- Google Spreadsheets: For tracking investments and calculating gains or losses.

- Twitter: To stay updated on events and relevant news.

- CryptoPanic: A news aggregator for market impact insights.

Chapter 2.2: Managing Risk Regardless of Market Trends

“Risk management” is a commonly discussed topic, but its meaning is often misunderstood. You can assess your risk tolerance using online calculators or by consulting a financial advisor. Generally, risk tolerance is categorized as Aggressive, Moderate, or Conservative. If you are uncomfortable losing any capital, you might have a low risk tolerance and should be cautious in your investments.

Regardless of market conditions, adhere to your predetermined risk level and avoid overextending yourself without thorough planning.

Conclusion: Cultivating a Long-Term Mindset

To reach your financial aspirations, adopt two key mindsets: view your financial journey as a marathon, not a sprint. This perspective fosters patience and allows for gradual growth while mitigating the risk of hasty decisions that could jeopardize your finances.

Investing with a long-term outlook can yield significant returns, especially if you start small and focus on sustainable practices rather than fixating on immediate gains. Picture this progression as climbing stairs—each step brings you closer to your goals while helping you manage risk effectively.

Stay Safe and Stay Informed.

For further insights, explore my other articles, including “10 Questions to Ask Before Investing in DeFi” and “Let’s Be Honest About The Future of Crypto.” Thank you for reading!